Do you ever get the feeling our leaders don’t know what the hell they’re doing?

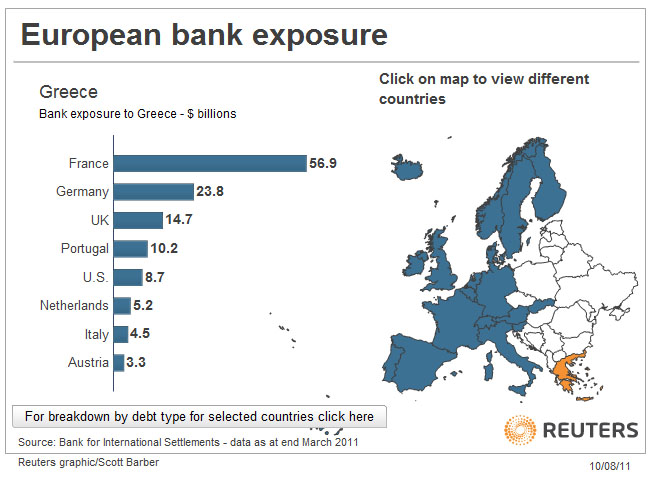

The Finns want collateral. Mr Barroso at the Commission wants to sell Euro Bonds. The Germans don’t. The Greek people want to default. The French banks are desperate that they don’t. Tim Geithner wants Europe to follow America’s lead and create a super expanded bail out fund like America’s TARP. The Austrian parliament declined to fast track the idea through their parliament. No one is sure if this is Austrian pedantry or a refusal. In the UK the long awaited Vickers report on Bank ‘reform’ is welcomed and given a timetable of …2019…because obviously when you’re in a crisis you don’t want to hurry.

In Italy austerity plan 1 was passed and then eaten by ‘special interests’ till there was nothing left. The ‘perfectly well capitalized’ Italian banks who had disdained raising cash earlier suddenly began an accelerated kind of rot so that they seemed to crumble in on themselves life a leper with a failed face lift.

As fast as our leaders plan to put money in to the banks, depositors, especially large financial institutions and other European banks are taking their money out (100 billion euros have left Italian banks this year so far) and putting it in American banks. At the same time American Money Market Funds have also stopped lending to European banks.

But, the American banks are now lending billion of that money back to the European banks via long duration repo agreements (an agreement in which you ‘sell’ an asset but with the agreement to repurchase the assets at a fixed time and at a fixed price). Thus it is less like selling and more like pawning. And so, to solve their short term funding the European banks are pledging assets that are still worth something at American banks who funnily enough find themselves flush with cash.

But then help is at hand in th eform of a conference call no less betwen Merkel, Sarkozy and Papandreou in which it is revealed to a waiting world that, “Greece will meet its obligations and stay in the Euro block.” There that was easy wan’t it. Makes you wonder why they didn’t just say so before!

http://www.golemxiv.co.uk/2011/09/they-havent-a-clue/#comments